Donation of real estate in Bulgaria: important aspects and tips

In recent years Bulgaria has been attracting more and more foreigners who want to invest in real estate or gift it to their relatives. The process of gifting real estate in this country, despite its apparent simplicity, contains a number of nuances and legal peculiarities that are important to consider. In this article we will look at the key aspects related to donation real estate in BulgariaWe will also offer useful tips to help you avoid common mistakes and make the process as transparent and safe as possible for both parties. By familiarizing yourself with our information, you can feel confident in matters relating to property and the legal rules associated with its donation.

Table of Contents

- Advantages of donating real estate in Bulgaria

- Legal aspects of property transfer

- Taxes and financial obligations in case of donation

- Recommendations on drawing up documents and choosing a notary public

- Frequent questions and answers

- Conclusion

Advantages of donating real estate in Bulgaria

Gifting real estate in Bulgaria opens up many opportunities for the giver and the recipient. First of all, it can be a great way to strengthen family or friendship ties, as well as to support people you care about. Unlike other countries, the process of donating real estate in Bulgaria is quite easy and transparent, which makes this procedure attractive to many people. In addition, such a step can be financially advantageous as well, since real estate in Bulgaria often has a steady rise in prices.

There are also practical advantages, such as:

- Tax Benefits: In some cases, the donor is exempt from income tax.

- Ease of design: The process of transferring ownership usually requires a minimal amount of paperwork.

- Simplification of inheritance issues: Gifting real estate can reduce the problems associated with inheritance.

In addition, it is worth bearing in mind that there are some important aspects of the Donation Agreement. For example, it should be remembered that the transaction must be notarized, which provides legal protection for both parties. It is also a good idea to consult a lawyer beforehand to avoid possible misunderstandings. Proper preparation and understanding of all the processes will make gifting real estate a pleasant and hassle-free step.

Legal aspects of property transfer

The transfer of property in the form of a gift of real estate requires careful attention to legal nuances. First, the legal capacity of the donor and the donee should be assessed. Make sure that both parties are fully authorized to enter into the transaction and that there are no restrictions that could affect the legality of the transfer. This is especially important if the donor owns property that is encumbered by a mortgage or other encumbrances.

Secondly, it is necessary to take a close look documentsrelated to the donation process. Pay attention to the following points:

- Notarization: the transaction requires notarization, which ensures its legitimacy.

- Gift Statement: it is important to draw up a detailed application that specifies all the terms of the gift.

- Registration of title: After signing the agreement, the transfer of rights must be registered with the local registration authority.

| Document | Description |

|---|---|

| Donation agreement | The main document containing the terms and conditions of the real estate transfer. |

| Notarization | Necessary to confirm the legality of the transaction. |

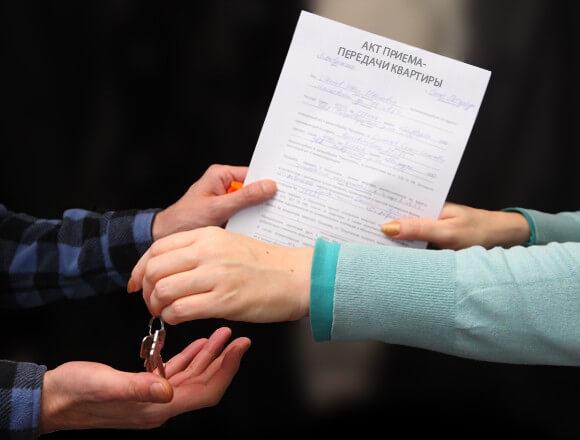

| Act of transfer | A document recording the actual transfer of the property. |

Taxes and financial obligations at giving

When donating real estate in Bulgaria, it is necessary to consider a number of tax and financial obligations that may arise for both the donor and the donated property. First of all, it is worth mentioning the following gift taxwhich is assessed on the value of the transferred property. The tax rate varies by region and ranges from 0.5% to 2% of the assessed value of the property. The donor becomes liable for this tax and must file a tax return with the tax authorities within the following time period thirty days from the date of the deed of gift.

In addition, other financial liabilities may arise, such as notary fees и state fees. The notary who formalizes the transaction usually charges a fixed fee, which depends on the value of the property. It is also worth considering that registered debts and encumbrances on the object may be transferred to the giver. Thus, it is recommended to study in detail all the information about the status of the real estate and consult with lawyers before the transaction:

| Obligation | Description |

|---|---|

| Gift tax | 0.5% - 2% of the appraised value |

| Notary costs | Depends on the value of the property |

| State fees | Fixed fee according to legislation |

Recommendations on drawing up documents and choosing a notary public

Proper paperwork is a key step in the process of transferring real estate in Bulgaria. Be sure to take into account the following recommendations:

- Document verification: Make sure that all necessary documents such as certificates of ownership and technical passports are in order and up to date.

- Choosing a notary: The notary should have experience with real estate transactions. Make sure he or she is accredited and has good references.

- Checking the object's history: Before the transaction, check to see if there are any encumbrances or debts associated with the property.

In addition, it is important to consider changes in laws and regulations regarding real estate transactions. Here are some tips for choosing a notary:

- Recommendations from friends or colleagues: Seek advice from those who have already successfully completed similar transactions.

- Comparison of conditions: Feel free to interview several notaries about service fees and turnaround times.

- Personal communication: Meet with the notary before the transaction to make sure he or she is professional and willing to help you.

Frequent questions and answers

Questions and answers about donation of real estate in Bulgaria

Question 1: What are the basic rules for donating real estate in Bulgaria? Answer: Gifting real estate in Bulgaria requires following a number of legal procedures. It is necessary to draw up a written contract of donation, which must be notarized. It is also important to ensure that there are no debts or encumbrances on the property being donated.

Question 2: What are the taxes and fees associated with the donation of real estate in Bulgaria? Answer: When donating real estate in Bulgaria, the donor and the donated property may be required to pay a gift tax, which ranges from 0.1% to 3% depending on the value of the property and the relationship between the parties. Additional fees may also be required for notarization of the transaction and registration of changes in the land registry.

Question 3: What are the rights of the donee after the transaction is finalized? Answer: Upon successful completion of the donation process, the donor becomes the full owner of the property. He/she can use, sell or rent the property in accordance with the current Bulgarian legislation.

Question 4: Can foreigners give or receive real estate in Bulgaria as a gift? Answer: Yes, foreigners have the right to give and receive real estate in Bulgaria as a gift. However, it should be taken into account that there are some restrictions for foreign citizens on ownership of land, so it is important to consult a lawyer before formalizing the transaction.

Question 5: What documents are required to execute a deed of gift? Answer: The following documents will be required to execute the gift agreement: passport of the donor and the donated person, notarized certificate of ownership of real estate, documents confirming the absence of debts and encumbrances, as well as an estimate of the value of the property, if it is required for tax calculation.

Question 6: How can I avoid disputes when gifting real estate? Answer: In order to avoid possible disputes, it is recommended to clearly specify all the terms of the transaction when executing the gift agreement and consult with an experienced lawyer. Recording the transaction in the registry will also help to avoid misunderstandings in the future.

Question 7: What advice can you give to those who are planning to gift real estate in Bulgaria? Answer: First of all, it is recommended to consult a qualified lawyer in order to avoid legal mistakes. It is also worthwhile to analyze possible tax consequences in advance, to draw up all documents properly and to be attentive to the internal rules and requirements of the Bulgarian legislation.

Conclusion

Gifting real estate in Bulgaria is an urgent process that requires a careful approach and understanding of legal nuances. Correct paperwork, knowledge of tax obligations and peculiarities of local legislation play a key role in the successful completion of the transaction. By following the advice outlined in this article, you will be able to avoid common mistakes and ensure the legality of your actions. Don't forget that consulting with a qualified attorney or realtor can be the key to your safety and confidence in your chosen path. Gift real estate wisely and be confident in every step!